Federal Poverty Guidelines – Helps with calculating income-driven repayment.Income-Driven Repayment Calculator – Shows your estimated monthly payment under the various income-driven repayment plans.Weighted Average Interest Rate Calculation – Simplifies various calculations by giving you one interest rate that can be used in all your student loan repayment calculations.Student Loan Repayment Calculators – Three different student loan calculators that help you visualize what sort of impact putting additional dollars towards your loans will have.

This will be where all your student loan detail is laid out in a nice snapshot.

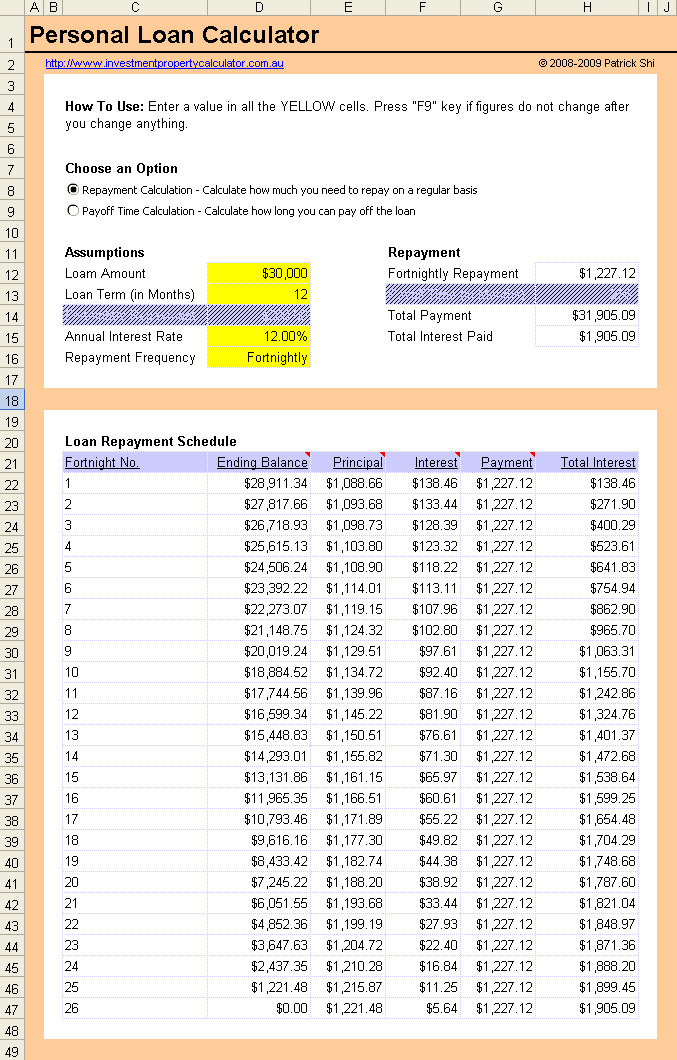

Which brings me to the student loan spreadsheet I’m sharing with you today. The one thing you can do, though, is feel in control. There is no magical way to get rid of them quickly, especially if you have a lot of them. Listed below are other spreadsheets by that use an amortization table to both display results and perform calculations.Student loans can be complex. In that article, I explain what happens when a payment is missed or the payment is not enough to cover the interest due. If you are wanting to create your own amortization table, or even if you just want to understand how amortization works, I'd recommend you also read about Negative Amortization. To get started, I would recommend downloading the Simple Amortization Chart template.

You can delve deep into the formulas used in my Loan Amortization Schedule template listed above, but you may get lost, because that template has a lot of features and the formulas can be complicated. My article " Amortization Calculation" explains the basics of how loan amortization works and how an amortization table or "schedule" is created. Learn how to create a simple amortization chart with this example template.

0 kommentar(er)

0 kommentar(er)